This analysis examines the impact of debt service suspensions (DSS) and credit moratoriums (CM), particularly in the context of their widespread use during global economic crises, and the reactionary interest rate increases implemented to tackle inflation.

The Mechanism of Deferred Risk

Debt service suspensions and credit moratoriums have been implemented globally to prevent defaults and avoid economic collapse during periods of crisis. These tools were deployed at all levels: from IMF facilities to personal debt, corporate bonds, and even rent repayments.

However, the long-term consequences of this practice remain under-researched, with significant unexplored risks to the global financial system. When the deferred impact of DSS and CMs is realized, it may trigger a liquidity squeeze that could lead to:

- A "shock" shortage of cash supply

- Higher borrowing costs than anticipated

- Supply and demand shocks

- Lower asset prices

While the benefits of widespread DSS during crisis periods were evident in preventing immediate collapse, the deferred impact, though mitigated, remains unrealized in many economic models.

Why Standard Models Miss This Risk

DSS and CMs are tools that prevent defaults on debt obligations (loans, bonds) to stabilize markets while providing lenders with a recovery mechanism. They defer the impact of default on liquidity by allowing borrowers to temporarily suspend debt payments.

DSS and CMs are not directly the cause of a liquidity crisis per standard practice. However, the global application of these tools deflected normal circulation patterns in ways that many quantitative macro models do not comprehensively account for. The circulation of capital was artificially maintained at levels that masked underlying stress.

The "False Liquidity" Problem

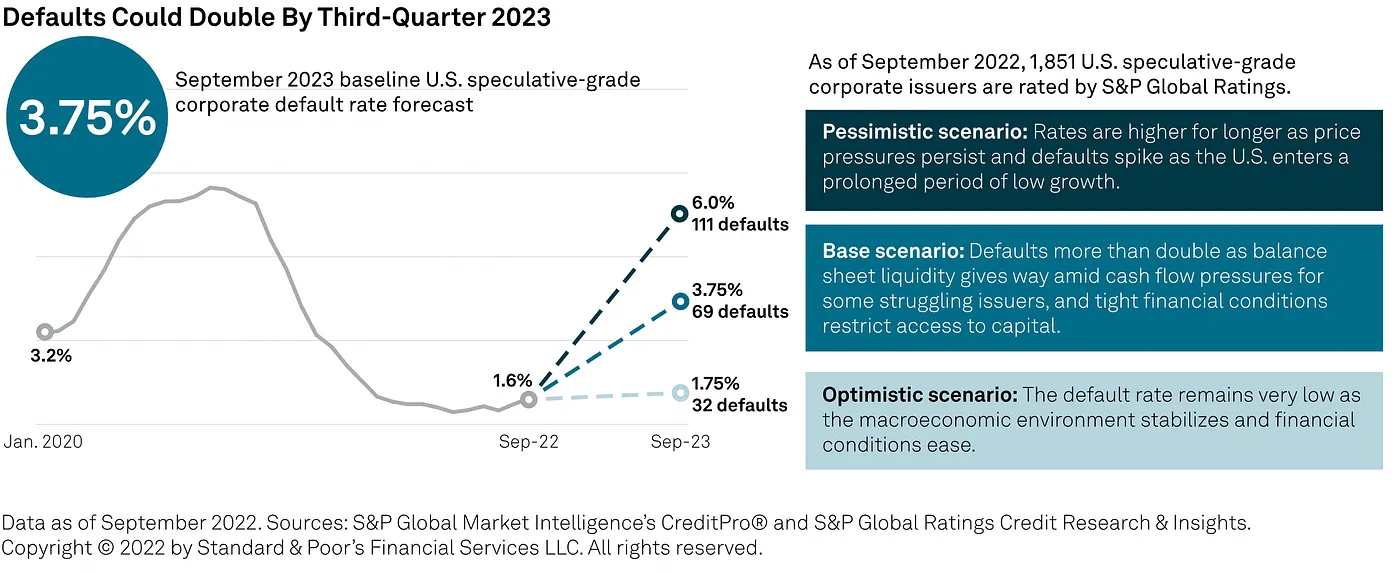

Standard default rate forecasts may not adequately account for the potential impact of DSS/CMs. The liquidity that appeared in the system was in some sense "false" because it was predicated on deferred obligations that would eventually come due. When credit practices normalize, the elasticity of market cash flow could be significantly impacted.

Default rate scenarios: The range of outcomes when deferred obligations normalize

The Potential Cascade

While mild recession scenarios are typically anticipated in standard forecasts, there is a risk of a negative cycle triggered by DSS and CM impact on liquidity that could cause more severe disruption. This could manifest as:

- Higher default rates than forecasted

- Increased borrowing costs beyond projections

- Tight credit liquidity disrupting the circular economy

- A "superposition" of default and liquidity shortage

This superposition effect, where multiple stress factors compound simultaneously, could lead to further destabilization of the global financial system beyond what linear models predict.

Recommendations for Risk Management

Policymakers and financial institutions should address this risk and ensure preparedness for the potential impact of DSS/CMs on credit cycles:

1. Enhanced Research and Modelling

Conduct further research on the long-term consequences of DSS/CMs and their potential impact on credit cycles and the global financial system, including the effects of global deflection of cash flow. Current models need to explicitly incorporate these deferred obligations.

2. Contingency Planning

Develop contingency plans to address potential risks of a liquidity squeeze or other negative consequences resulting from DSS/CMs, using framework criteria reflective of quantitative models that account for deferred obligations.

3. Alternative Policy Tools

Consider alternative policy tools that may be more effective in preventing defaults and stabilizing markets during economic crises. A more distributed approach to dealing with default at an institutional level, with potential for long-term deferment of failed securities, may provide better outcomes than blanket suspensions.

4. Cautious Monetary Policy

Take a cautious approach to injecting liquidity or increasing interest rates, considering the potential impact of DSS/CMs on credit and cash flow. The interaction between rate increases (to control inflation) and deferred debt obligations creates complex dynamics.

5. Micro-Macro Integration

Improve understanding of how micro and macro dynamics of credit interact with quantitative models. Policy decisions informed by models that miss these dynamics may produce unexpected outcomes.

First Principles Risk Assessment

- →Deferred obligations do not disappear; they accumulate

- →Global coordination of suspensions created global correlation of risk

- →Standard models may underestimate default rates post-moratorium

- →Liquidity can appear stable while underlying stress builds

- →Interest rate increases compound pressure on deferred obligations

Implications for Credit Analysis

This analysis suggests that credit analysis frameworks need to explicitly account for DSS/CM effects. When evaluating credit risk in the current environment, analysts should consider:

- The proportion of an entity's obligations that were subject to deferral

- The timing of when deferred obligations become due

- The correlation between multiple entities' deferred obligations

- The capacity of the entity to service normalized obligations in a higher-rate environment

Standard credit metrics may need adjustment factors to account for the artificial stability created by suspension programs. What appears to be a strong payment history may mask underlying stress that will materialize when obligations normalize.